30

08 月

ARDF Webinar: Insights on Sustainability Disclosure Standards and ISSB

On August 25, the Accounting Research and Development Foundation in Taiwan (ARDF) hosted an online webinar on international sustainability standards, featuring a keynote speech by Ms. Katie Schmitz Eulitt, Senior Market Co-Lead for APAC Outreach from IFRS.

The webinar also included an opening speech by Chen-Shan Chang, Director-General of the Securities and Futures Bureau (SFB) under the Financial Supervisory Commission (FSC) in Taiwan, and expert panels participated by ARDF Chairwoman, senior sustainability professionals from KPMG and Deloitte & Touche and Zhong-hao Huang, Director of Accounting and Auditing Supervision Division of SFB.

With nearly 300 participants joining the online event, speakers shared insights and exchanged views on key global trends in sustainability standard-setting, with discussion centering on the work of the International Sustainability Standards Board (ISSB) as well as IFRS S1 and IFRS S2, the two exposure drafts that had been published for public consultation in March.

In this article, we will focus on the following two speeches of the webinar to provide brief summaries and present key takeaways:

- Opening speech by Director-General Chang

- Keynote speech by Ms. Eulitt from IFRS

Opening Speech: SFB Director-General Shares Latest Regulatory Developments on Sustainability Reporting in Taiwan

Director-General Chang began his speech by referencing the COP26 Goals, which focus on mitigation, adaptation, finance and collaboration, and noted FSC’s work has been closely aligned with these four aspects.

Before diving into details on sustainability-related regulatory initiatives in Taiwan, Change talked about the bigger context by sharing three key international trends in the field:

- Global baseline: a trend of convergence is taking place in sustainability reporting standards and frameworks given resounding demand for more consistent and comparable sustainability information

- Climate first: climate-related risks remain a priority area for sustainability disclosures

- Compulsory: as regulations continue to tighten around the world, compulsory disclosures and external assurance are the trend

Brining focus to the development of sustainability reporting regulations in Taiwan, Chang noted several themes of focus in FSC’s policies. These themes are all part of the Corporate Governance 3.0 Sustainable Development Roadmap (CG 3.0), a three-year roadmap to strengthen corporate governance and sustainable development efforts.

1. Aligning with international reporting standards: policy measures along this line include asking companies to refer to TCFD recommendations and SASB standards when compiling sustainability reports. Chang noted that FSC is closely following the work of ISSB and IFRS to consider potential application in Taiwan.

2. Expanding the scope of companies required to prepare sustainability reports: in Taiwan, the scope of sustainability reporting has expanded to include all listed-companies with a paid-in capital of NT$2 billion, which has been required to prepare and file sustainability reports starting from 2023 (that is, to have sustainability reports for 2022 ready next year). Chang also highlighted FSC’s latest policy update, which will require all listed and OTC companies to disclose climate-related information in annual reports published after January 1, 2024.

3. Strengthening third-party assurance: following the CG 3.0 roadmap, FSC is expected to further expand the scope of companies and industries whose sustainability reports would need to be validated by third-party assurance, with assurance on GHG emissions data as a priority item

2. Expanding the scope of companies required to prepare sustainability reports: in Taiwan, the scope of sustainability reporting has expanded to include all listed-companies with a paid-in capital of NT$2 billion, which has been required to prepare and file sustainability reports starting from 2023 (that is, to have sustainability reports for 2022 ready next year). Chang also highlighted FSC’s latest policy update, which will require all listed and OTC companies to disclose climate-related information in annual reports published after January 1, 2024.

3. Strengthening third-party assurance: following the CG 3.0 roadmap, FSC is expected to further expand the scope of companies and industries whose sustainability reports would need to be validated by third-party assurance, with assurance on GHG emissions data as a priority item

The Origins of ISSB

Keynote speaker Ms. Eulitt, currently Senior Market Co-Lead for APAC Outreach at IFRS, first provided the audience with an overview of IFRS and ISSB.

Going back to 2020, Eulitt noted IFRS had long been aware of demand from the investor community for international sustainability standards for an investor audience. From the 700+ comment letters received that year, investors also voiced their hope that such global standards should be “climate-first,” which meant climate-related topics and information should be of key focus.

These considerations culminated with IFRS’ announcement at COP26 in November 2021 to establish the International Sustainability Standards Board (ISSB), which has been tasked to “deliver a comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities,” as noted on IFRS’s official website.

Global Baseline Developed with a Building Blocks Approach

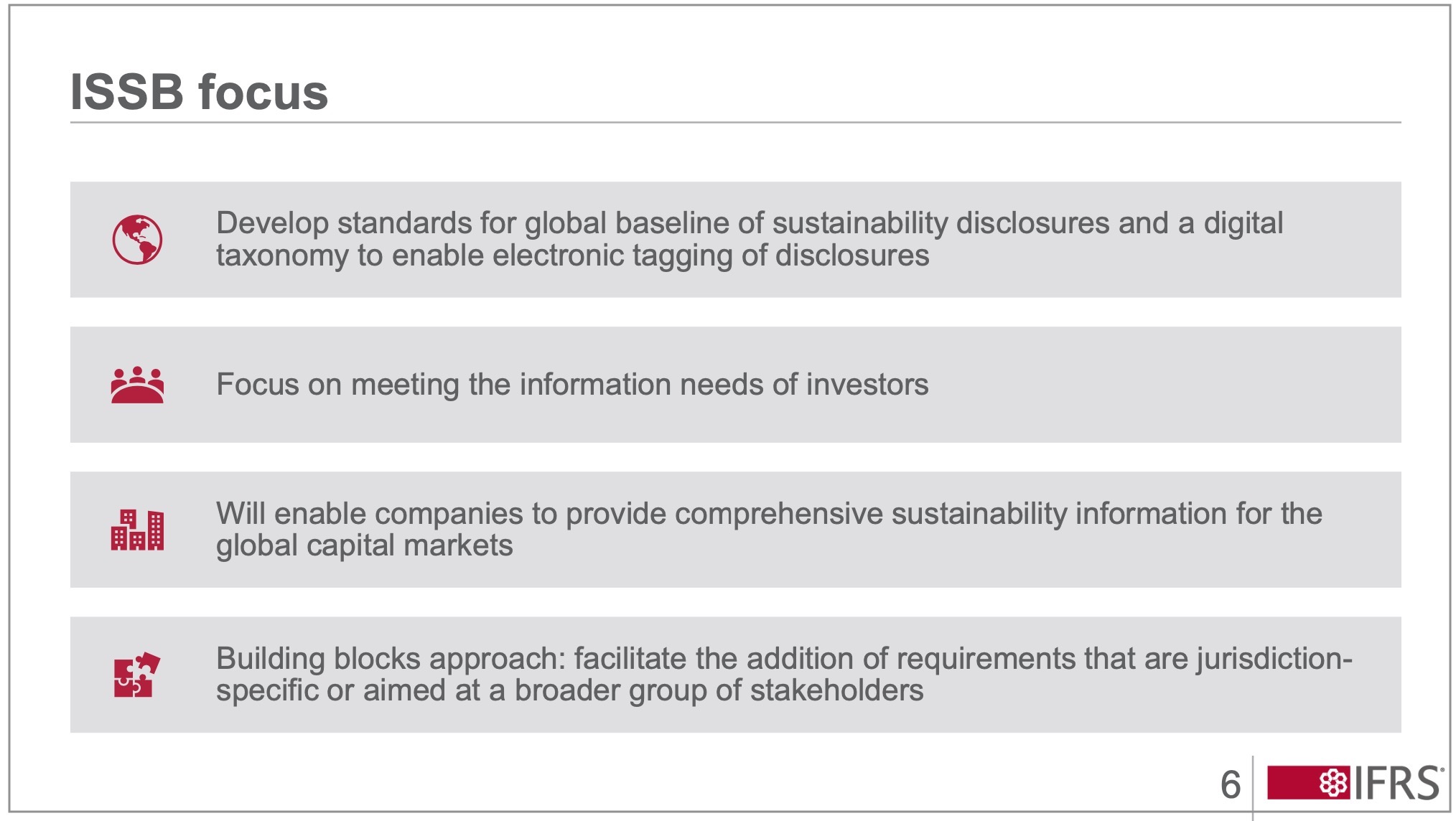

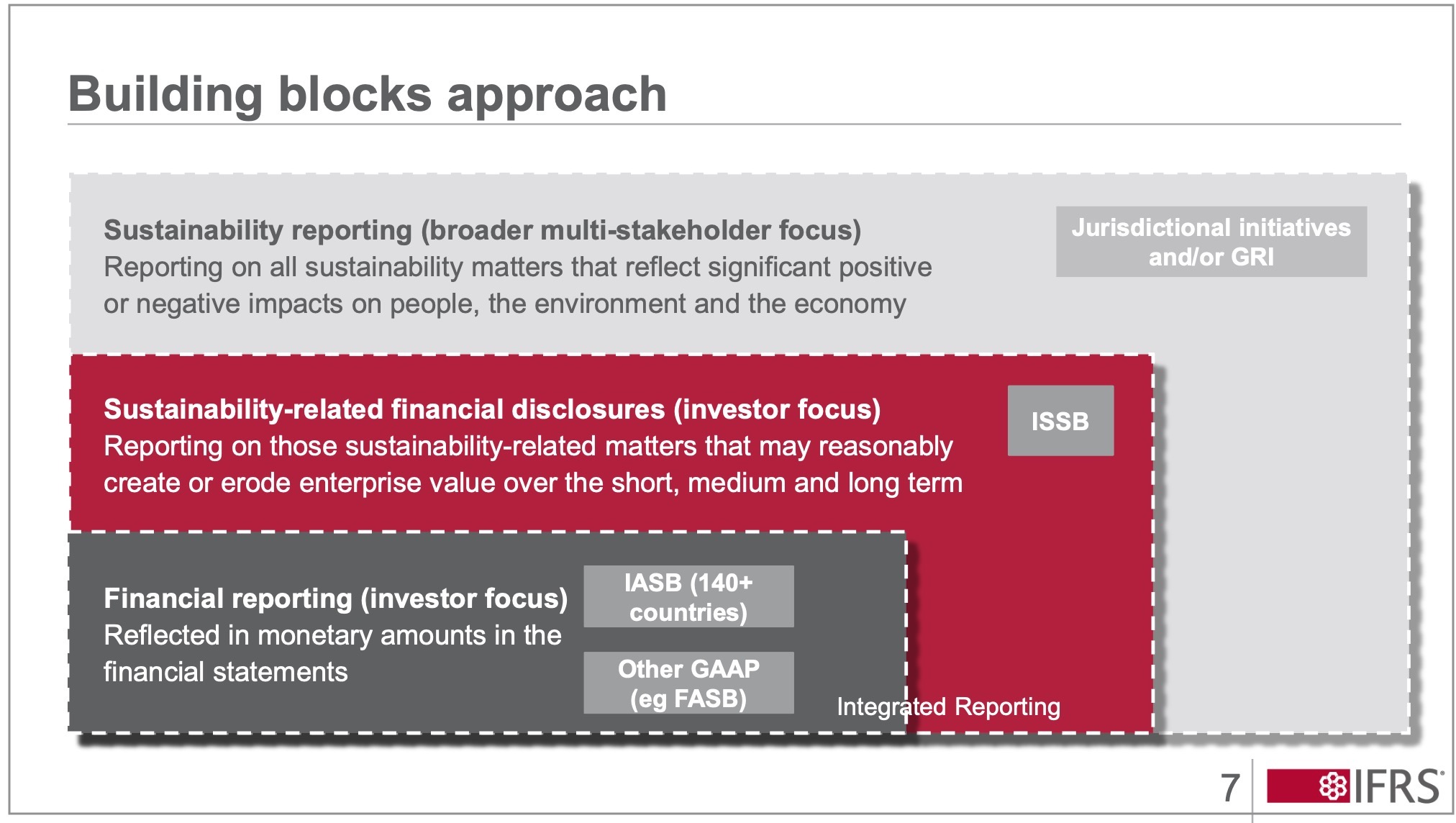

Moving on to ISSB’s current work and progress, Eulitt again stressed that ISSB is focusing on developing standards for a “global baseline of sustainability disclosures” which aim to “meet the information needs of investors,” as noted in her presentation slide below.

She also highlighted the “building blocks approach,” an essential feature of ISSB’s standard-setting work. The building blocks approach means that the global baseline standards will be based upon existing frameworks such as the SASB standards and TCFD framework, as opposed to being developed from scratch. Furthermore, IFRS’ proposed standards themselves should serve as a building block, upon which jurisdictions can build more requirements based on their specific needs or stakeholder groups.

Source: IFRS

Source: IFRS

Going back to 2020, Eulitt noted IFRS had long been aware of demand from the investor community for international sustainability standards for an investor audience. From the 700+ comment letters received that year, investors also voiced their hope that such global standards should be “climate-first,” which meant climate-related topics and information should be of key focus.

These considerations culminated with IFRS’ announcement at COP26 in November 2021 to establish the International Sustainability Standards Board (ISSB), which has been tasked to “deliver a comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities,” as noted on IFRS’s official website.

Global Baseline Developed with a Building Blocks Approach

Moving on to ISSB’s current work and progress, Eulitt again stressed that ISSB is focusing on developing standards for a “global baseline of sustainability disclosures” which aim to “meet the information needs of investors,” as noted in her presentation slide below.

She also highlighted the “building blocks approach,” an essential feature of ISSB’s standard-setting work. The building blocks approach means that the global baseline standards will be based upon existing frameworks such as the SASB standards and TCFD framework, as opposed to being developed from scratch. Furthermore, IFRS’ proposed standards themselves should serve as a building block, upon which jurisdictions can build more requirements based on their specific needs or stakeholder groups.

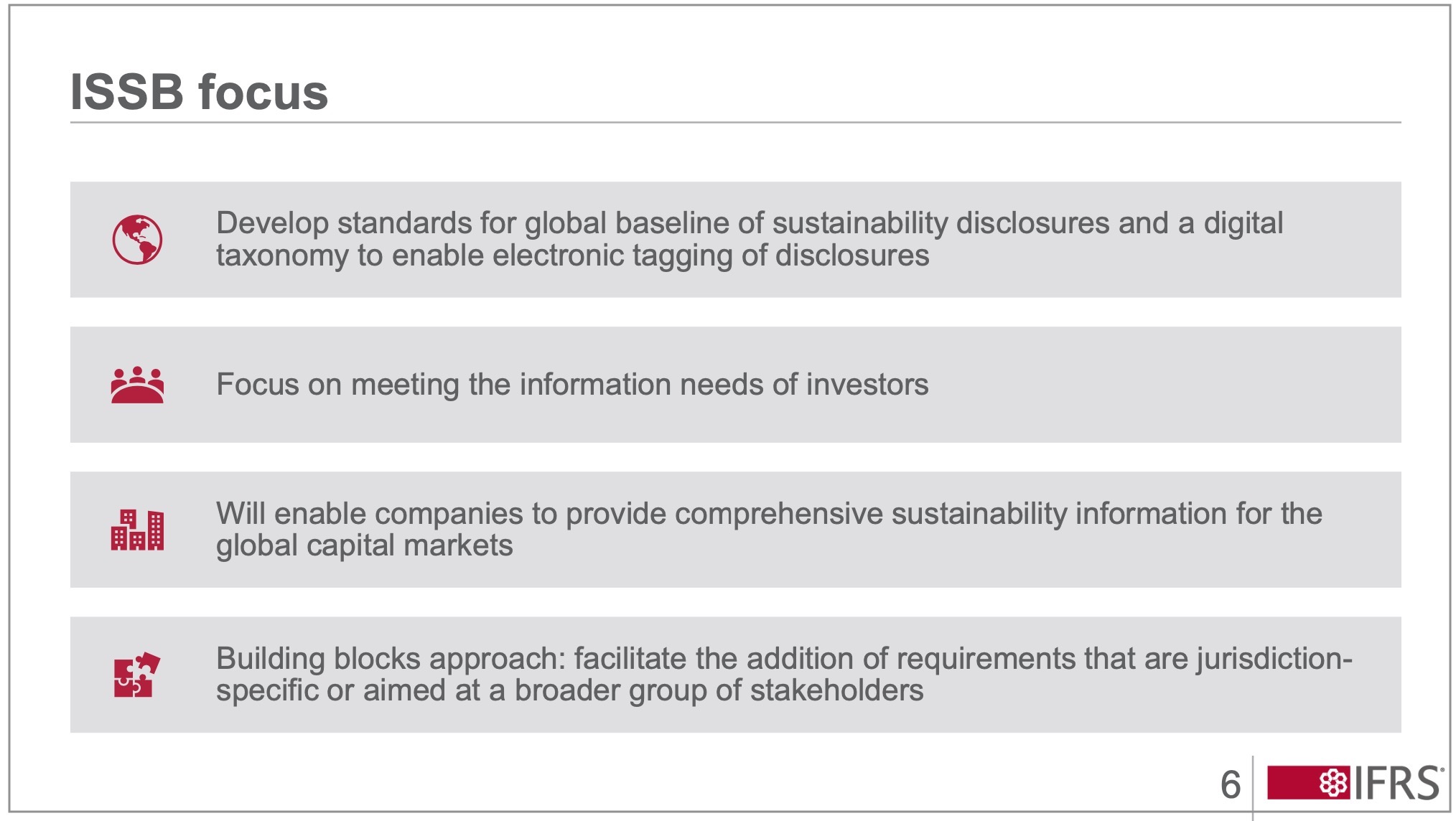

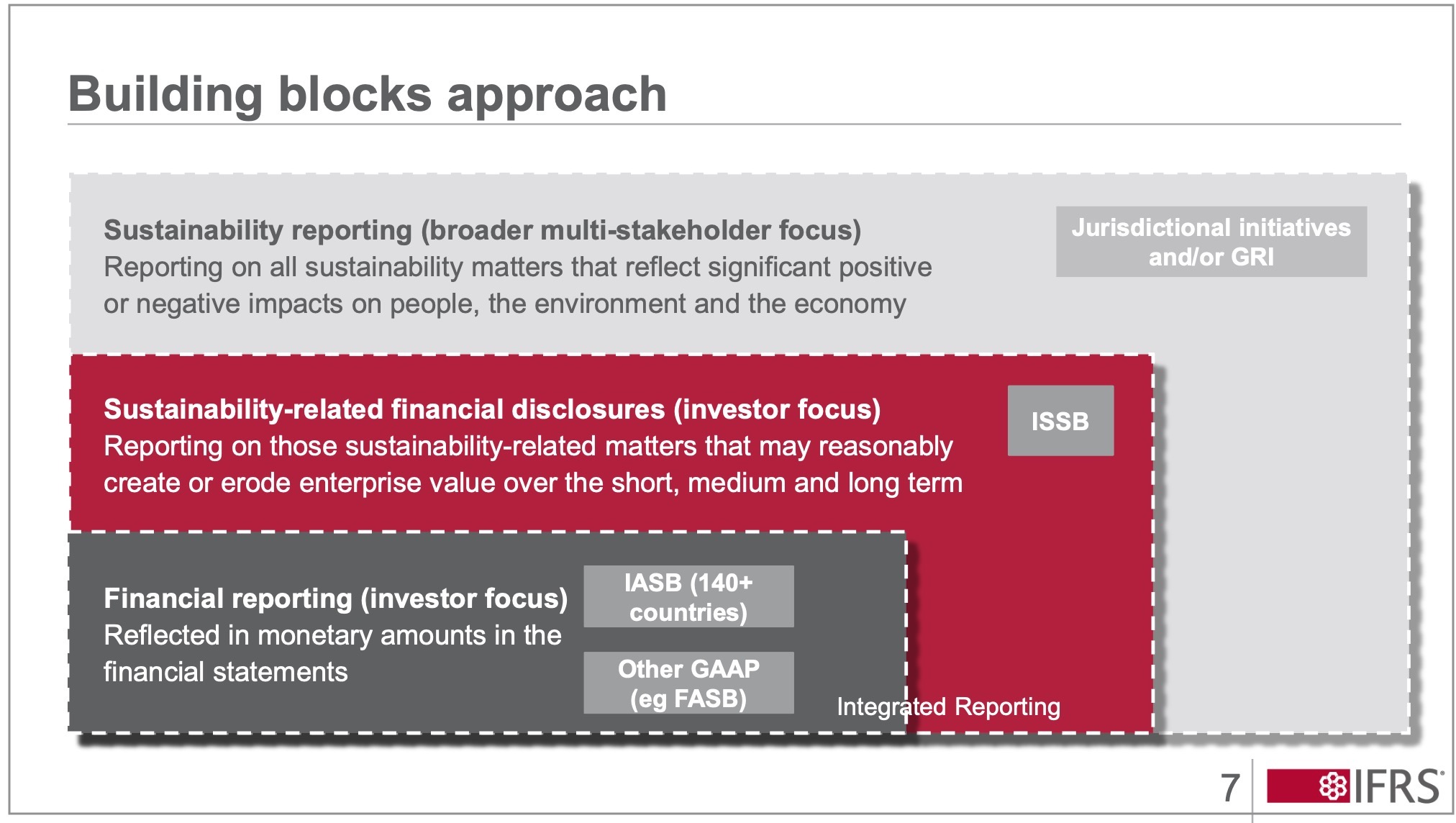

Where ISSB Stands: Connecting Financial Disclosures with Sustainability Reporting

Using the following slide, Eulitt presented a bird’s-eye-view of the corporate reporting landscape, explaining how different pieces of standards and frameworks fit together to meet information needs of different stakeholder groups. Sitting in the red box in the middle, ISSB is positioned to become the global standard for sustainability-related financial disclosures.

Eulitt also pointed out the dotted lines, which she described should represent the idea that there isn’t a solid line between issues that are not financially material today and issues that become financially material tomorrow.

Adding on to that, she explained this was why ISSB and GRI had signed an MOU in March, announcing they would coordinate on standard-setting activities to ensure interoperability between standards set by the two organizations. Reiterating what’s stated in the MOU, Eulitt noted that the idea was that the GRI Standards and IFRS’ sustainability disclosure standards would become two pillars in sustainability reporting, one serving multi-stakeholder needs and the other being investor-focused.

Eulitt also pointed out the dotted lines, which she described should represent the idea that there isn’t a solid line between issues that are not financially material today and issues that become financially material tomorrow.

Adding on to that, she explained this was why ISSB and GRI had signed an MOU in March, announcing they would coordinate on standard-setting activities to ensure interoperability between standards set by the two organizations. Reiterating what’s stated in the MOU, Eulitt noted that the idea was that the GRI Standards and IFRS’ sustainability disclosure standards would become two pillars in sustainability reporting, one serving multi-stakeholder needs and the other being investor-focused.

Source: IFRS

Preliminary Feedback on IFRS S1 and IFRS S2

The final part of Eulitt’s keynote speech focused on the preliminary feedback IFRS has consolidated based on the 1,300+ comment letters received during the 120-day consultation period for the IFRS S1 and IFRS S2 exposure drafts (visit the official webpages here and here for more information about the exposure drafts).

Before presenting an overview of the preliminary feedback, Eulitt noted that the ISSB board has reached a quorum and would be reviewing the comment letters in the coming months, with the revised standards expected to be completed in 1Q2023.

Preliminary analysis categorized public feedback into five themes: proportionality, enterprise value, timing, data challenges and industry-based requirements. The “proportionality” theme reflects public concerns over the proposed standards’ applicability to small and medium-sized enterprises (SMEs) and the emerging market, while the “timing” theme highlights another key concern over difficulty for companies to be able to simultaneously publish their financial and sustainability reports. Eulitt noted ISSB is actively seeking more feedback and discussing innovative solutions in response to the raised concerns.

Q&A Session Highlights

The informative keynote speech was followed by a Q&A session hosted by the Chairwoman of ARDF. Here we present some key takeaways from the lively discussion among Ms. Eulitt and senior sustainability professionals, including Zhong-hao Huang, Director of Accounting and Auditing Supervision Division of SFB; Winston Yu, Chief Sustainability Officer at KPMG Taiwan; and Brian Chi Kuen Ho, Partner and Climate & Sustainability Assurance Lead (APAC & SEA) at Deloitte & Touche Singapore.

Note: questions and Ms. Eulitt’s responses have been summarized for content and brevity.

Sources:

Preliminary Feedback on IFRS S1 and IFRS S2

The final part of Eulitt’s keynote speech focused on the preliminary feedback IFRS has consolidated based on the 1,300+ comment letters received during the 120-day consultation period for the IFRS S1 and IFRS S2 exposure drafts (visit the official webpages here and here for more information about the exposure drafts).

Before presenting an overview of the preliminary feedback, Eulitt noted that the ISSB board has reached a quorum and would be reviewing the comment letters in the coming months, with the revised standards expected to be completed in 1Q2023.

Preliminary analysis categorized public feedback into five themes: proportionality, enterprise value, timing, data challenges and industry-based requirements. The “proportionality” theme reflects public concerns over the proposed standards’ applicability to small and medium-sized enterprises (SMEs) and the emerging market, while the “timing” theme highlights another key concern over difficulty for companies to be able to simultaneously publish their financial and sustainability reports. Eulitt noted ISSB is actively seeking more feedback and discussing innovative solutions in response to the raised concerns.

Q&A Session Highlights

The informative keynote speech was followed by a Q&A session hosted by the Chairwoman of ARDF. Here we present some key takeaways from the lively discussion among Ms. Eulitt and senior sustainability professionals, including Zhong-hao Huang, Director of Accounting and Auditing Supervision Division of SFB; Winston Yu, Chief Sustainability Officer at KPMG Taiwan; and Brian Chi Kuen Ho, Partner and Climate & Sustainability Assurance Lead (APAC & SEA) at Deloitte & Touche Singapore.

Note: questions and Ms. Eulitt’s responses have been summarized for content and brevity.

Q: What do you think would be the impact of the IFRS S1 and IFRS S2 standards?

A: The IFRS sustainability standards would represent an important evolution in sustainability reporting. The current landscape is a patchwork system of voluntary standards and frameworks, which can be burdensome for companies and couldn’t fulfill the information needs of investors. The IFRS standards should help simplify the sustainability reporting process and improve consistency, which in the long run would reduce companies’ reporting burden.

But of course, for companies that have just started their sustainability reporting journey, adapting to new standards and getting the needed internal controls in place may present a learning curve, if not a steep one.

Q: What do you think would be the key challenges companies may face when adopting the sustainability standards released by ISSB?

A: First of all, we’re glad to see that adoption of SASB standards and TCFD framework to significantly pick up since 2015. They’re now neck and neck with the GRI Standards. That doesn’t mean GRI adoption has decreased, but that these standards and frameworks are complementary.

Having that familiarity with SASB and TCFD is great for reporting companies. Major challenges probably still lie in data collection. Many companies’ data collection and internal control systems for sustainability reporting are far from mature, which spells difficulties in collecting the required data and ensuring data quality.

Compared with financial reporting practices, which had a 20-year head start, sustainability reporting is only still a work in progress. The next big step for companies is to improve the sophistication of their internal system to gradually evolve to the same level of the data quality of their financial reporting.

Q: In Taiwan, we tend to focus more on risks rather than opportunities. Could you share more about the opportunity part of sustainability disclosures?

A: It’s natural for companies to look at risks first. Given the scale of climate change, it makes sense to first evaluate risks from an operations perspective. But as businesses adopt an integrated reporting mentality tolook at their business models more comprehensively, opportunities should surface, for example, opportunities in climate change mitigation. There would be a lag between reckoning the risks and identifying opportunities. It would also depend on the industry a company operates in, given different industries have different levels of exposure and opportunities in store.

A: The IFRS sustainability standards would represent an important evolution in sustainability reporting. The current landscape is a patchwork system of voluntary standards and frameworks, which can be burdensome for companies and couldn’t fulfill the information needs of investors. The IFRS standards should help simplify the sustainability reporting process and improve consistency, which in the long run would reduce companies’ reporting burden.

But of course, for companies that have just started their sustainability reporting journey, adapting to new standards and getting the needed internal controls in place may present a learning curve, if not a steep one.

Q: What do you think would be the key challenges companies may face when adopting the sustainability standards released by ISSB?

A: First of all, we’re glad to see that adoption of SASB standards and TCFD framework to significantly pick up since 2015. They’re now neck and neck with the GRI Standards. That doesn’t mean GRI adoption has decreased, but that these standards and frameworks are complementary.

Having that familiarity with SASB and TCFD is great for reporting companies. Major challenges probably still lie in data collection. Many companies’ data collection and internal control systems for sustainability reporting are far from mature, which spells difficulties in collecting the required data and ensuring data quality.

Compared with financial reporting practices, which had a 20-year head start, sustainability reporting is only still a work in progress. The next big step for companies is to improve the sophistication of their internal system to gradually evolve to the same level of the data quality of their financial reporting.

Q: In Taiwan, we tend to focus more on risks rather than opportunities. Could you share more about the opportunity part of sustainability disclosures?

A: It’s natural for companies to look at risks first. Given the scale of climate change, it makes sense to first evaluate risks from an operations perspective. But as businesses adopt an integrated reporting mentality tolook at their business models more comprehensively, opportunities should surface, for example, opportunities in climate change mitigation. There would be a lag between reckoning the risks and identifying opportunities. It would also depend on the industry a company operates in, given different industries have different levels of exposure and opportunities in store.

Sources:

- https://www.accupass.com/event/2208190654132146734615

- https://www.ifrs.org/content/dam/ifrs/project/climate-related-disclosures/supporting-materials/issb-webinar-presentation-april-2022.pdf